To many persons, eCommerce is the use of credit cards only to pay for goods and services online. This is not the case. According to Wikipedia: eCommerce, is the trading or facilitation of trading in products or services using computer networks, such as the Internet or online social networks. Two noticeable things about the definition are that it is broad and the mode of payment is not prescribed.

There are three main aspects to eCommerce; order management, payment processing, and delivery. The purest form of eCommerce is where all three stages occur online. For example, in the purchase of digital goods like an ebook from Amazon. You order the ebook online, make the payment online and receive delivery of the ebook via the internet. Most orders (of physical goods) from Amazon are two parts online and one part offline. That is, you place the order and make the payment online. However, delivery occurs offline. This is the most common form of eCommerce.

Other forms of eCommerce include the order of goods online only. Payment and delivery occur offline. For example in Germany, invoicing is the most popular means of payment for online shopping. Invoice payments rank first followed by credit card payments. With invoice payments, the customer orders the goods online and receives delivery of the goods including an invoice. The customer either pays for the goods upon receipt or at a later point in time. Typically, payments are made within 10 – 15 working days. Sweden is another country where invoice payment for online purchases is popular.

The beauty of eCommerce in these countries is that popular modes of payment are based on cultural factors. Hence, online businesses in these countries have adapted to modes of payments that are acceptable to the population. In fact, they provide more than one payment option to meet the preferences of customers.

These different payment modes are not as popular in the North American model of eCommerce that we are familiar with. Nevertheless, they form a practical way of getting paid.

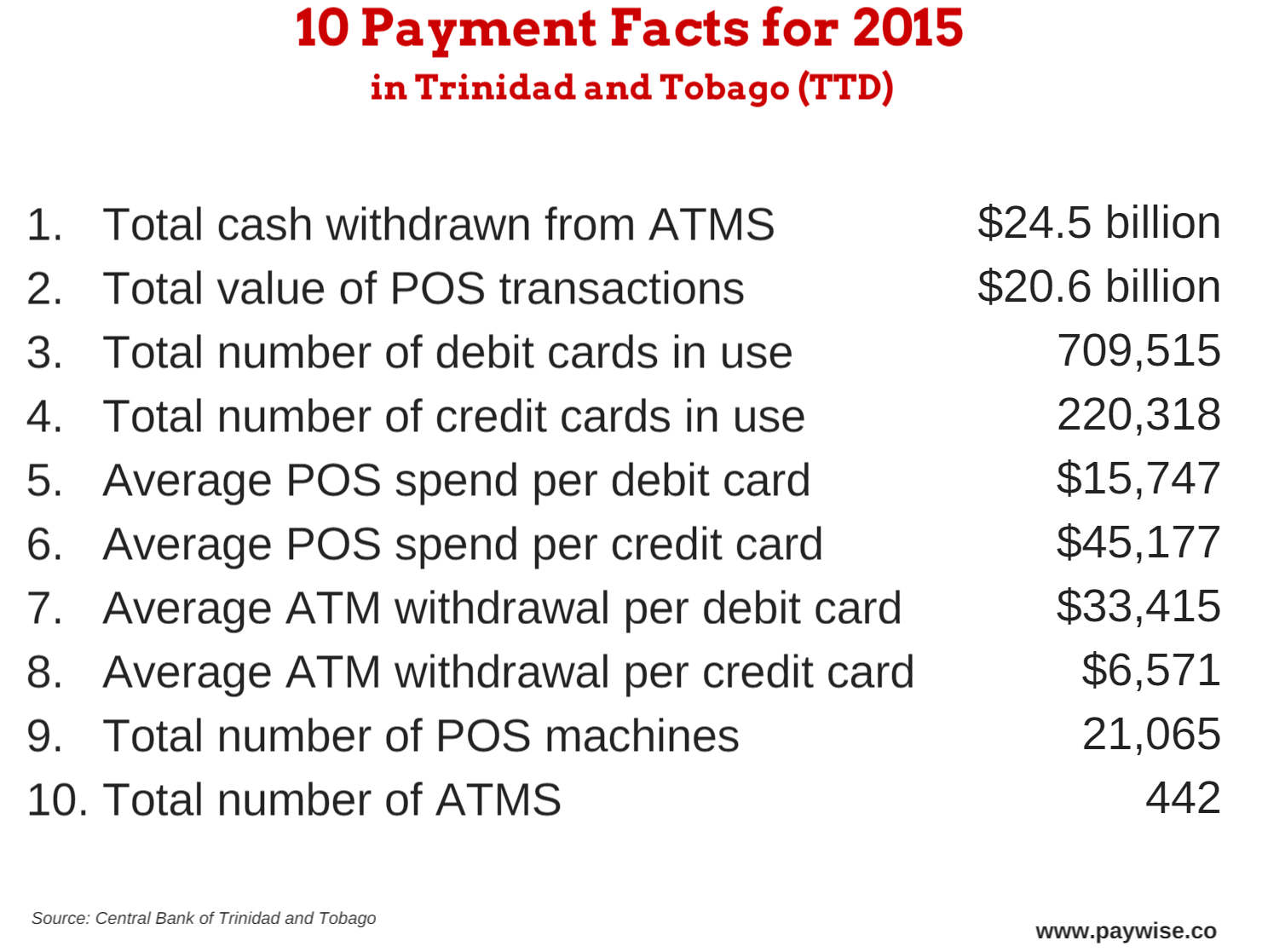

In Trinidad and Tobago, a similar pragmatism should apply. Credit card penetration in the US is about 66%. Hence, the credit card-centric payment model. Locally, according to the Central Bank, credit card penetration is about 20%. Including prepaid cards the figure is 25%. This means that over 75% of the adult population or roughly 824,000 persons have cash to spend but no means to conduct payments online. Online businesses must realize that the acceptance of credit card payments only, may impose an artificial limit on their customer base.

Paywise was created to provide a cash payment option for eCommerce in Trinidad and Tobago.