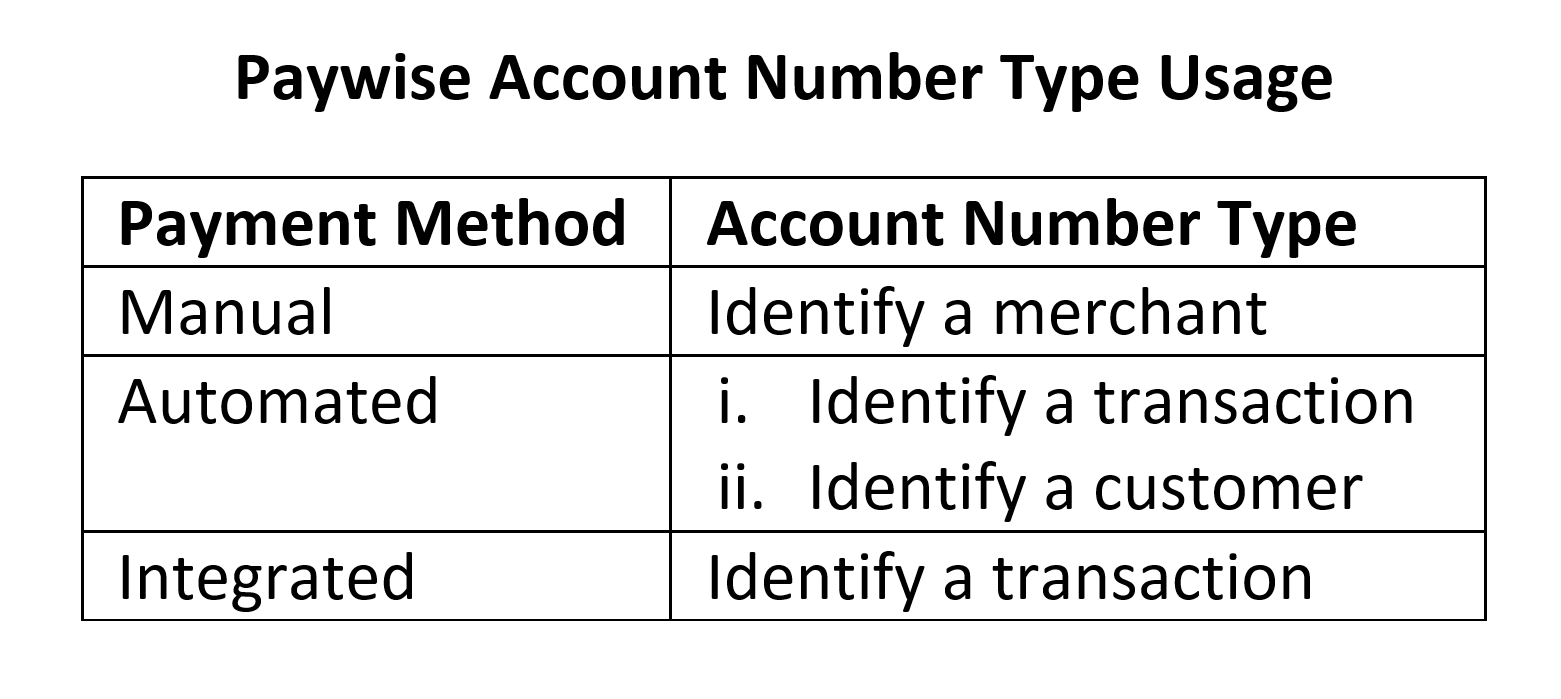

The Paywise Account Number is a 12 digit number that can be used to identify a merchant, a customer or a transaction. As mentioned in a previous article there are 3 payment methods in Paywise: Manual, Automated and Integrated. The type of account number used depends on the payment method.

The Paywise Account Number is used to identify the merchant. It represents the account number assigned to the merchant by Paywise. The merchant provides customers with the Paywise Account Number to make payments at the LOTTO VIA agents. This number is fixed for all payment transactions to the merchant. This number type is used for the Manual Payment Method only.

Identify a Transaction

In this case, the Paywise Account Number represents a transaction number generated by the merchant. Each customer is given a unique transaction number by the merchant. Each time a customer conducts a transaction a unique number is given to him to make a payment.

Identify a Customer

The Paywise Account Number represents a customer. Some organizations, like associations, want to identify payments made by members. So the Paywise Account Number represents the member’s identification number. This enables the organization to recognize members by name whenever dues are paid and easily reconcile their accounts.

Two Account Number Types

Generally, a merchant will use a single account number type. However, two account number types (transaction and customer) can be used. For one off transactions or first time customers the merchant can issue a transaction number. However, for repeat customers the merchant then issues a unique customer number to each customer.

For example, an association may issue a transaction number to an applicant in order to pay a registration fee. Once the application is processed and accepted the association then issues a customer number to the member. The member uses this number to make all subsequent payments.

Merchants that select the Automated Payment Method may use both the transaction and customer account types.

To manage the account numbers in Paywise is a very easy and simple process. Upon registration, we provide merchants with guidance on how to do so.