Security enhancement was the main reason local banks upgraded the LINX debit cards to the VISA Debit (LINX) cards. By doing so the banks reduced the incidents of skimming and card replication. However, there were secondary benefits like contactless payments and online payments. The promise of online payments using the new cards was a boon for many, but this has not lived up to expectations. There are some grey areas which this short article aims to address.

Note, the information in this article was gleaned from calls to local banks’ call centres and information available on their website. The banks checked were Royal Bank, Republic Bank, First Citizens Bank and Scotiabank. Response from some banks were clear and informative. Banks’ websites contained scant to very useful information about the new card, features, and fees.

The main takeaways from the exercise are: (1) not all banks’ VISA Debit (LINX) cards work online (2) only one VISA Debit (LINX) cards works internationally (3) transaction limits apply (4) transaction fees are high.

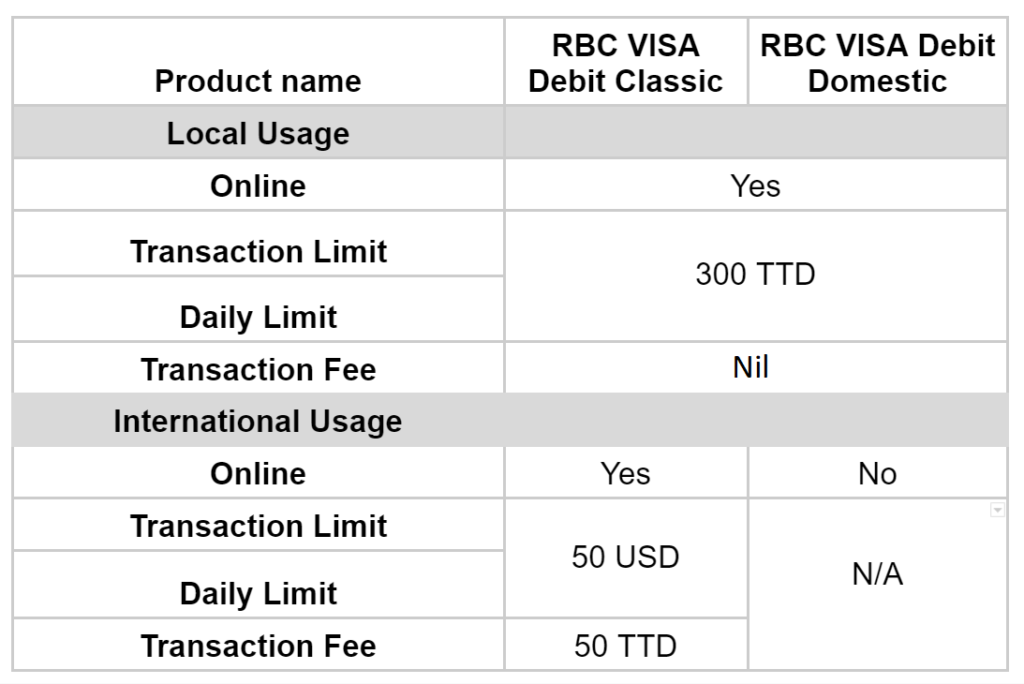

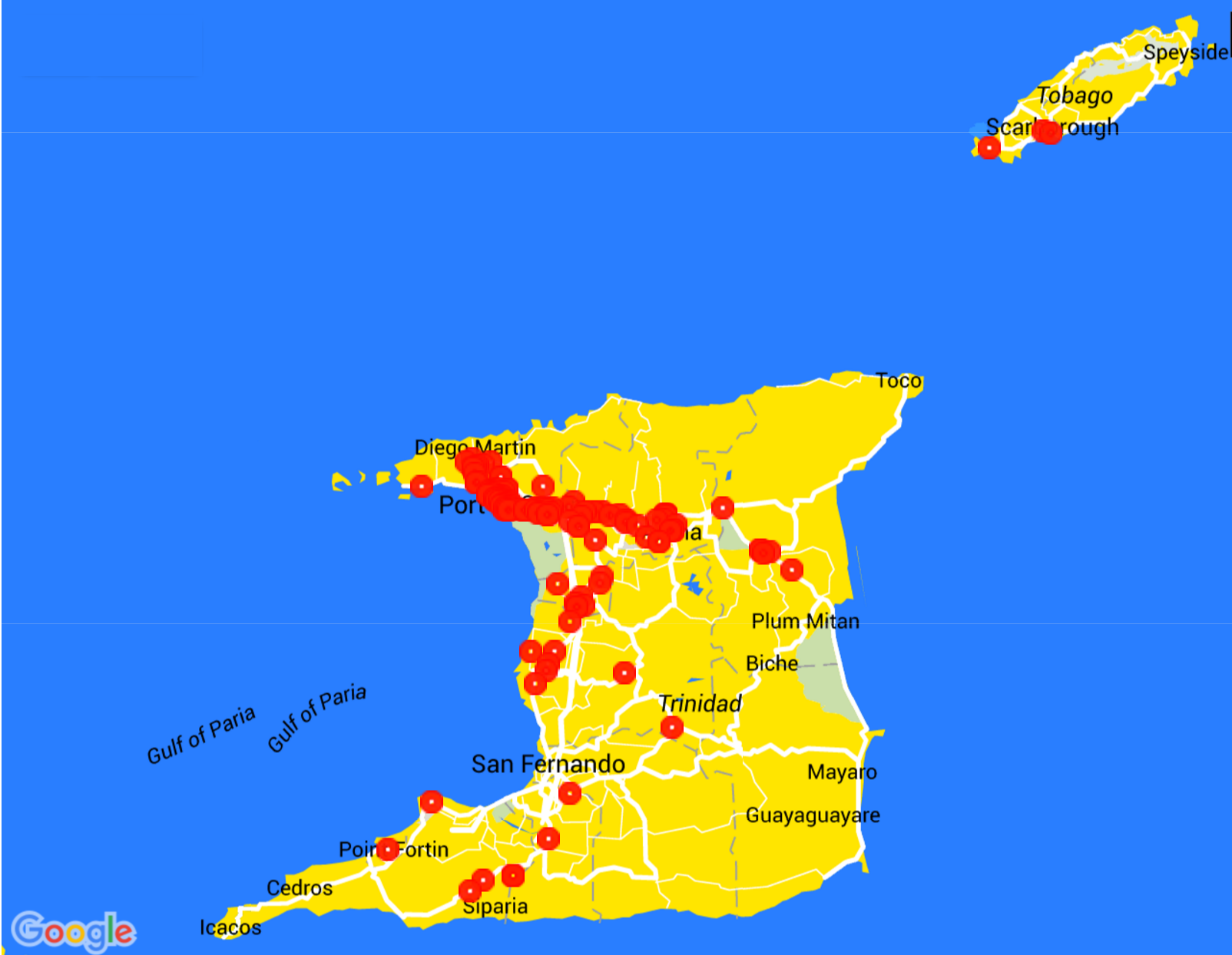

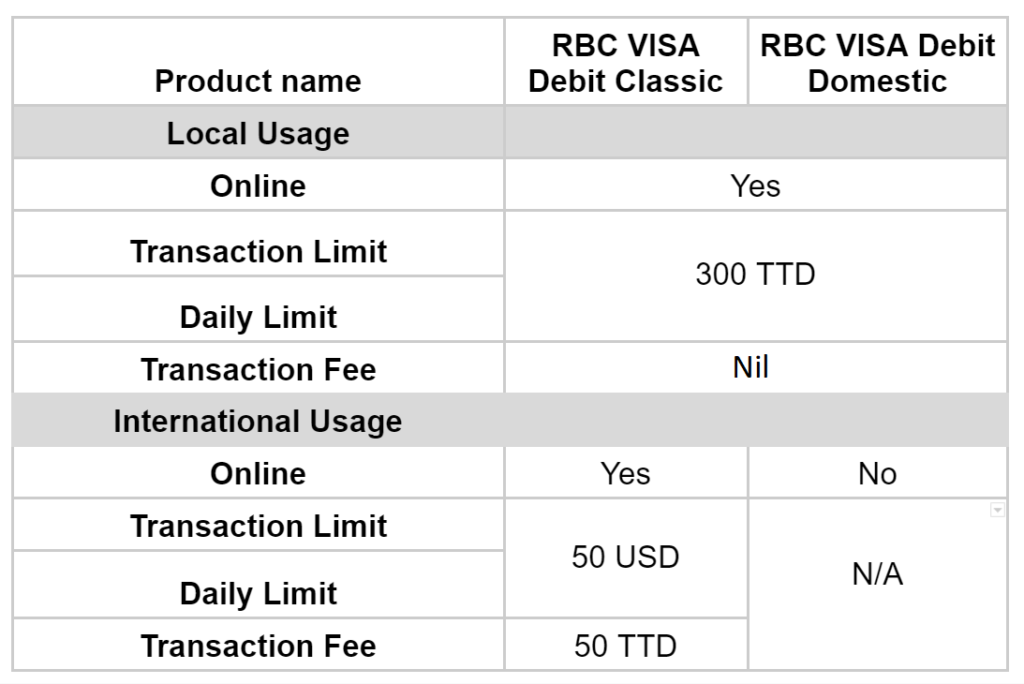

Royal Bank was clear and transparent about their card products and the information was easily found online. See table. Scotiabank cards can be used online locally but it may only be usable at select online stores. Details about the card usage was accessible. According to the customer representative, the Republic Bank OneCard Visa Debit cannot be used online (as yet). No information was obtained about the First Citizens Bank. (See Notes below for updates).

Banks limits the value of contactless payments at point-of-sale machines. Some banks have a limit of $300. Online payment using a Royal Bank VISA Debit (LINX) card is limited to $300; Scotiabank $340.

Credit card transaction fees are paid by the merchant. However, for VISA Debit (LINX) cards both the customer and the merchant may be changed. Royal Bank charges the customer TTD 50 on foreign transactions only; the merchant is charged the normal credit card fee.

In closing, the VISA Debit (LINX) card was primarily introduced for security reasons so don’t expect broad online features, at least not soon. Depending on the bank, VISA Debit (LINX) may not be suitable for large payments and frequent daily usage; fees can be high. Your best bet for online purchases remains the credit cards and pre-paid debit cards.

Note:

On 2022-06-08, the post was changed to reflect that Royal Bank charges the TT 50 on foreign transactions only.

2022-06-11: We were reliably informed that First Citizens and Republic Bank cards work online.

![]()