There are several ways to receive payments. Payment options range from the traditional cash to modern day electronic payments. In this article we examine payment instruments and the payments systems available to local businesses.

PAYMENT INSTRUMENTS

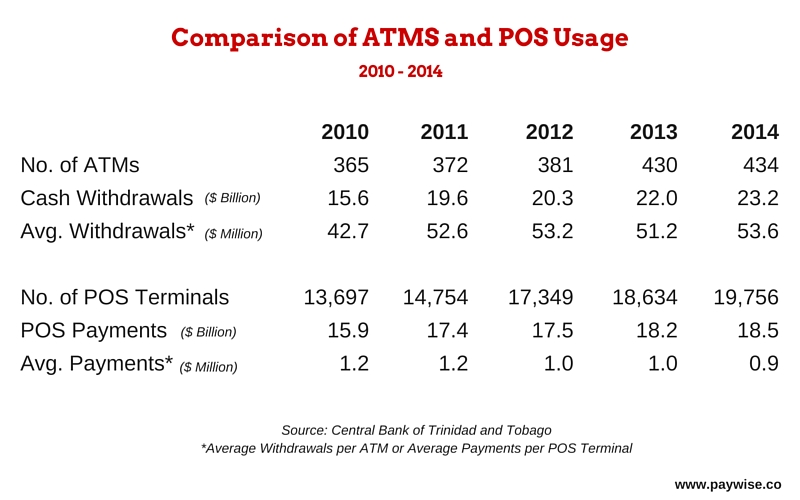

The main payment instrument is cash. Non-cash payment instruments are debit cards, credit cards, cheques and bank drafts. Despite the high usage of non-cash payment instruments cash still remains the most widely accepted means of payment.

PAYMENT MECHANISMS

A payment mechanism is a financial system that supports the transfer of funds from payers to payees usually via financial institutions. There are paper-based mechanisms to handle checks and drafts, and paperless mechanisms to handle electronic transactions. Electronic funds transfer payment mechanisms are the back bone of ecommerce.

LOCAL PAYMENT MECHANISMS

Paper Based Mechanisms

Traditional payment systems offered by banks to facilitate payments using cheques and bank drafts.

Electronic Payment Mechanisms

LINX – an electronic network that facilitates point-of-sale transactions using payment cards (debit and credit cards). Transactions are conducted via point-of-sale machines (fixed or mobile) at the merchant. Since a physical payment card must be presented to the merchant to conduct the payment such transactions are referred to as card present transaction.

Automated Clearing House (ACH)

ACH is an electronic transfer system that is commonly used as a payment system. Using ACH payers issue payment instructions electronically via their online bank accounts. ACH then moves the funds from the payer’s account to the payee’s account.

Bill Payment System

A system where a payer makes bill payments via a third party (network of agents) to the biller. Locally, TTEC customers pay their bills through the VIA Bill Payments service.

Money Transfer Services

A system where money is transferred from one place to another. Typically, cash is sent from one person to another.

Ecommerce Payment Systems

These systems facilitate electronic payments for online transactions. Payments are made using credit cards. Local banks such as First Citizen Banks and Scotiabank offer ecommerce payment systems. A business has to obtain a merchant account to utilize the local ecommerce payment systems.

Foreign ecommerce payment systems include Paypal, Payoneer and 2Checkout. Paypal can be used by local businesses to accept payments online.

Alternative Payment Systems

These systems facilitate payments using a non-credit card alternative. Alternative payment methods include prepaid cards, debit cards, wallets and even cash. Alternative payment systems are increasingly being used for the payment of online transactions.

Paywise is a local alternative payment systems. The service accepts cash payments for online and offline transactions and transfers the payments to the merchants’ bank accounts.