Getting an online merchant account from a local bank is like pulling teeth. In the other countries businesses can accept payments online quite easily. Services like PayPal make the process quick and seamless. Locally, it is faster and easier to get a merchant account from PayPal than from the local banks.

In my previous article, Credit Cards, the Bank and You, the philosophy behind the credit card system was explained. The key takeaway was that due to the high risk, local banks are disinclined to grant smaller businesses online merchant accounts. You may ask then is the risk not high for PayPal? Yes, but PayPal can better manage the risk.

Several local banks have launched ecommerce payment services. Scotiabank, Republic Bank, First Citizen Bank and First Caribbean International Bank all have platforms. However, they focus mainly on the big and well-established entities. Most of us may not agree with this policy but we have to accept the fact that the banks have a right to assess and deal with the risks as they see fit. Case closed.

So that leaves smaller businesses with the international payment providers like PayPal. However, in using PayPal there are several drawbacks are:

- You can wait as long as 30 days to have access to your money. Meanwhile, you may have to fulfil the purchase before receiving the cash. This can result in a tight cashflow situation.

- To gain access to your money you must link a US bank account or a VISA debit/credit card to your PayPal account. Without the former the latter is the only alternative. If so, a cash advance (over the counter or via ATM withdrawal) is the standard way of getting your money. This attracts high fees (in some cases $20 for debit cards or 3% of the amount for credit cards).

To deal with the drawbacks think about the following:

Firstly, eliminate the cash advance fees. JMMB Bank, formerly Intercommercial Bank, has a VISA Debit card that links to a bank account. So when PayPal credits your card the funds go directly to your bank account. From there you can withdraw or transfer the funds without the exorbitant fees.

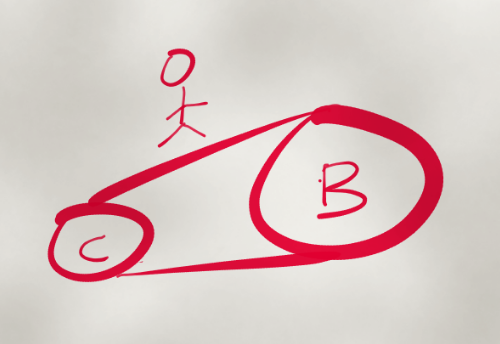

Secondly, solve the cashflow timing issue. This is a common businesses problem and which is solved by a bank overdraft. You take the money to fulfil the order from the overdraft account. Later, when the payment is received you credit the sum to the overdraft account.

Obtaining an overdraft account means being assessed and providing security. The process should not be as onerous as for an online merchant account and the security is dependent on the overdraft limit you want. The overdraft limit depends on the value of your monthly online sales or a lesser manageable amount. For example, let’s say your monthly online sales is $10,000 and the business can comfortably fulfil $3,000 worth of purchases from cash within the business. Then, you only need an overdraft limit of $7,000.

Alternatives to PayPal are Stripe and Payoneer. Unlike PayPal, these services allow access to funds within a shorter period; usually 2 days.