Local banks offer online merchant accounts that are tailored for big companies. The high cost of online merchant accounts is a strong disincentive for smaller entities to use the service.

Below is a quick examination of the fees charged by local banks for online merchant accounts.

Setup Fee

The charge ranges from USD 100 to USD 750 to set an account.

Security Deposit

The security deposit could be a minimum of $25,000.

Usage Fee Structure

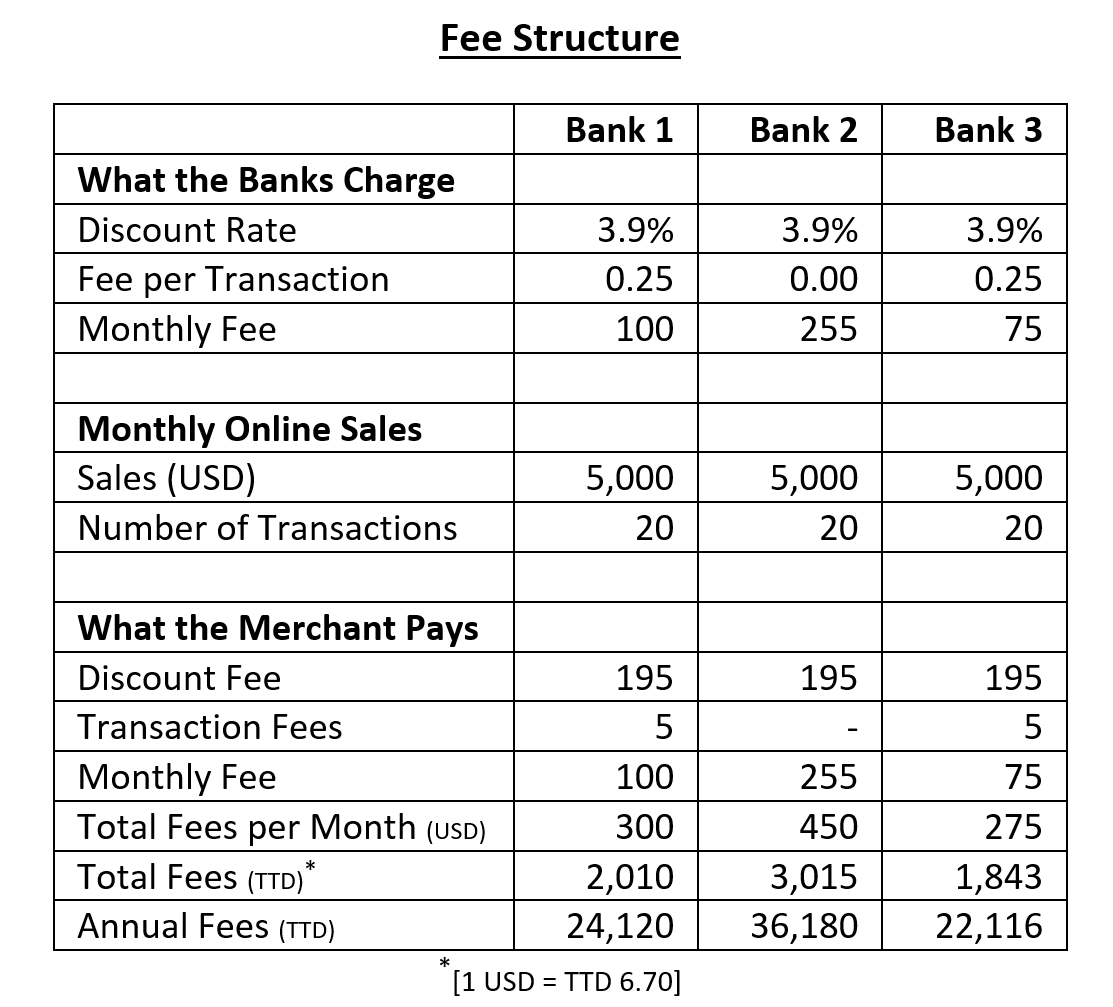

The usage fee structure refers to what merchants pay to use the service. The fee structure comprises a discount rate, a transaction fee and a monthly charge. The usage fee structure of three local banks are examined below.

Discount Rate

This is the interest rate charged by the bank on the credit card payment amount. This rate is assessed by the bank for each merchant. The higher the assessed risk the higher the rate.

Fee per Transaction

A fee charged per transaction. Normally, the fee is stated in USD cents.

Monthly Fee

This is a general fee charged per month regardless of any transaction activity. The fee is a USD dollar amount.

Fee Structure Applied

This is an example of the monthly sales and transaction volume for a merchant. Based on these figures the average monthly fees paid is calculated and an annual cost estimated.

A discount rate of 3.9% is used. In other words, it is assumed that all banks assess the same merchant at the same risk. However, this is not always the case.

Looking at the discount fee and the fee per transaction, there is no real difference in cost amongst the banks (based on the assumption that all banks assess the same merchant as the same risk).

However, the monthly fee makes a big difference in what is paid. Depending on the bank and total transaction value the monthly fee can account for over 50% of the fees paid.