Banks are responsible for both the cardholder and the merchant in a credit card transaction. As a cardholder, your bank is responsible for paying the merchant for your credit card purchases. On the other hand, the merchant’s bank is responsible for your refund claims against the merchant, for credit card purchases.

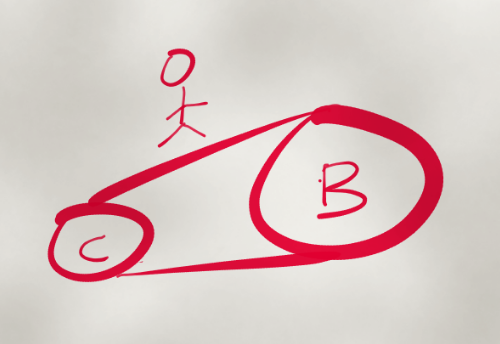

By issuing a credit card, the issuing bank is liable for purchases made by the cardholder using the credit card. In other words, if a cardholder purchases an item today but is financially ruined tomorrow the bank has to honor the payment. That is, pay the purchase amount to the merchant. Later, the bank will seek to recover the sum paid. Recovery may include taking the cardholder to court.

In order to accept credit card payments a business has to be granted a merchant account by a bank. The bank in this instance is called the acquiring bank. The acquiring bank, is liable for any refund or chargeback claim against the merchant, related to credit card purchases.

For example, persons purchase tickets on a chartered flight to an exotic destination months in advance using their credit cards. Close to the departure date the travel agent disappears. The ticket holders file chargeback claims. The acquiring bank, has to refund all persons who purchased tickets using their credit cards. Afterwards, the bank will seek to recover the funds from the vanished business. Recovery may include taking the merchant to court. The bank may recover all, part or nothing at all.

To manage the risk the acquiring banks closely vet all merchants. For brick and mortar businesses the process is time consuming. For online businesses it is rigorous.

So why is this so? As reported by Forbes “86 percent of chargebacks are fraudulent. The true cost of dealing with online fraud is growing”. According to a LexisNexis study, in 2014, the annual fraud cost among U.S. retailers was $32 billion, a rise of 38 percent from 2013.

Due to the scale of online fraud banks are exposed to a higher risk. The higher the risk the more collateral they require. The collateral, normally in the form of cash, is to cover chargebacks due to fraud and other reasons.

Assume the chargeback rate is 5%. That is, 5% of a merchant’s monthly sales are subject to chargeback claims by customers. If the business monthly sales is $100,000 then it refunds on average $5,000 per month. The acquiring bank will request at least $5,000 as security. When a chargeback claim is made the bank, if required, can make the payment from the collateral held.

The bank may request more security. Instead of $5,000, the bank may request cash collateral of $25,000. Hence, one may say the chargeback rate is 25%. Another way of looking at it is, the charge back rate is 5% but the additional $20,000 is a cushion for what the bank assesses as the risk associated with doing business with the merchant. In other words, the bank does not want to be out of pocket if claims exceed 5%.

In practice, once chargeback claims exceed the chargeback rate the bank will re-examine the business. This may result in a call for more collateral, restrictions on the account or cancellation of the merchant account.